Scheduled Benefit Deductions

How to schedule employee benefits to deduct at frequencies other than every pay cycle.

OVERVIEW

Scheduled deductions for benefits in Namely help you to align the frequency of paycheck deductions with your benefits configurations, allowing these deductions to be taken out of employees’ paychecks at frequencies other than with every pay cycle.

Adjusting deduction frequencies to align appropriately with your employees’ benefits configurations can eliminate the need for manual deduction suppressions and calculations while also ensuring that your deductions are accurate and fall within IRS maximum limits.

Note: The option for scheduling deductions is currently only available for the following:

-

Flexible Spending Account

-

FSA S125 Dependent Care

-

Health Savings Account - Self Only

-

Health Savings Account - Family

-

Section 132 Parking

-

Section 132 Transit

-

Post Tax Parking

-

Post Tax Transit

HOW IT WORKS

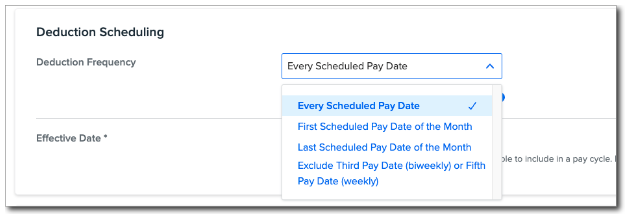

The following frequencies allow more flexibility when selecting how often new and existing deductions are taken out of employees’ paychecks:

-

Every scheduled pay date (default)

-

Just the first payroll of the month

-

Just the final payroll of the month

-

Just the first two (bi-weekly) or first four (weekly) payrolls of the month

Note: Employee-specific overrides are not possible when scheduling deductions. Employee deductions will occur at the company-level frequency that your administrator has selected.

Automatic Deduction Calculation

The Namely Enrollment Wizard recognizes when deductions are not applied to every pay cycle and calculates pay period deduction amounts accordingly based on the number of deductions made per month for, per the parking/transit deduction schedule and based on the number of remaining pay cycles for the year, per the HSA/FSA deduction schedule.

For plan year changes, this eliminates the need for administrators to manually calculate pay period amounts or suppress deductions in order to avoid exceeding annual contribution elections.

Plan Year Changes

The steps to make frequency changes to your deduction schedules will vary based on whether you’re changing an existing deduction or creating a new deduction.

Existing Deductions

For existing company deductions, note that deductions will continue to occur on every pay date by default unless you opt to change the deduction frequency by following the steps below. Also note that by default, deductions will continue to be applied to all manual pay cycles unless an administrator changes this option.

For this reason, if benefits deductions occur in months with additional pay periods—or if additional deductions occur in tandem with manual pay cycles—you may be at risk of exceeding monthly parking/transit deduction limits or yearly hsa/fsa deduction limits. In this case, you can change the frequency of deductions for existing benefits plans from employees’ paychecks.

To change the scheduled deduction frequency, you’ll need to make changes in your Namely Payroll and then in your organization’s Manage Benefits page:

Benefits

-

Navigate to your company Benefits page > Plan Setup.

-

Select the category your plan would fall under, the plan itself, and then click Renew.

-

For example, Transportation > Commuter & Parking > Renew.

-

-

Follow the prompts as they lead you through the renewal process.

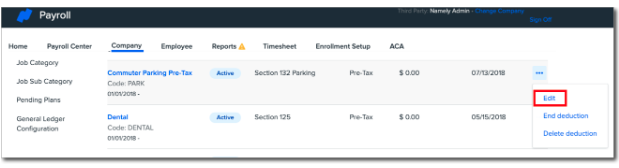

Payroll

-

In Namely Payroll, navigate to the Deduction Scheduling menu by going to Company > Deductions > Edit for the existing deduction.

-

Select your desired deduction frequency from the dropdown menu.

Note: If you select a deduction frequency that does not align with your pay frequency, the deduction schedule will revert to the default option and will be applied on every scheduled pay date.

For example, if your pay frequency is semi-monthly, but your administrator selects the Exclude Third Pay Date (biweekly) or Fifth Pay Date (weekly) deduction frequency, because semimonthly pay frequencies do not have a third or fifth payroll in any month, in effect the deduction frequency will act as every scheduled pay period.

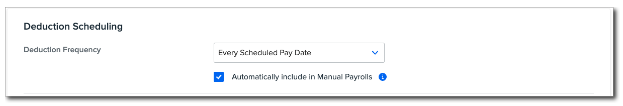

Excluding Deductions from Manual Pay Cycles

The option to include deductions in manual payroll cycles is selected by default when deductions are scheduled to occur at the default frequency (every scheduled pay date).

When selecting deduction frequencies other than the default frequency, the option to include deductions in Manual Payroll cycles is unselected by default to help ensure that deductions do not exceed IRS deduction limits.

Selecting Effective Dates for New Deduction Schedules

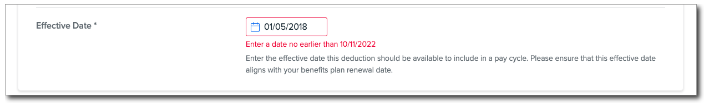

For existing deductions, the effective date in the Deduction Scheduling menu refers to the date when the original deduction was created (the “Start Date”). So when changing deduction frequency, you must select an effective date for the new deduction schedule to begin.

Note: For existing deductions, changes to deduction frequency cannot be applied retroactively. Effective dates for new deduction schedules must occur on today’s date or a date in the future.

As a rule of thumb, your deduction schedule effective dates should align with your Open Enrollment effective date. This will ensure that the deduction frequency aligns with your plan year deductions. Failure to do so could result in inaccurate employee deductions.

Creating New Scheduled Deductions

When creating a new deduction that you also plan to schedule, you’ll need to:

-

First, navigate to Company > Deductions in Namely Payroll.

-

Next, select a start date that is on or earlier than today’s date.

-

Note that the Manage Benefits menu will not recognize a deduction unless it has a start date on or earlier than today’s date—so be sure your effective date meets this requirement before attempting to configure the deduction. This will enable you to use it during Benefits Setup.

-

-

Select the deduction frequency Every Scheduled Pay Date.

-

Hit Save.

-

You can now edit the deduction frequency by clicking the three dots for your deduction and then select Edit from the dropdown.

-

Select the new deduction frequency you want.

-

In the deduction scheduling section there is a Effective Date field. Make the Effective Date match your benefits renewal date.

-

Hit Save.

Then, to configure the new deduction:

-

Navigate to your company Benefits page > Plan Setup > use the three-dot menu to select the Edit option > navigate to the Settings tab > scroll down to the Deductions menu > use the dropdown menus under the Post Tax heading to select your new deductions > click Publish & Exit.

-

Then, from the Plan Setup page > use the three-dot menu to select the Renew option.

To make further schedule changes for deductions with effective dates that are still in the future, you can do so in Namely Payroll without changing the effective date.

For example: It is September 29, 2022, and you have a new schedule of First Scheduled Pay Date of the Month beginning on January 1, 2023. You decide you would like to change the deduction frequency to Last Scheduled Pay Date of the Month but keep the same effective date. You can do this by repeating the steps above, changing only the deduction frequency and not the effective date.

Note: Do not make further schedule changes for deductions with effective dates that are still in the future if open enrollment elections have started.

Post Tax Parking & Transit Deductions

If you have employees whose commuter deductions exceed the IRS limit (meaning both pre-tax and post-tax deductions are used), you must create and utilize the new Post Tax Parking and/or Post Tax Transit deduction types.

To use new Post Tax Parking and Post Tax Transit deductions correctly:

-

When switching your organization’s post tax commuter deductions from a Post Tax Deduction type to a Post Tax Parking or Post Tax Transit type, note that since employee payroll deductions do not end at the end of a plan year, you will need to either:

-

End date your post tax deductions for employees who contribute to more than the IRS monthly commuter limit by navigating to Employee > Deductions.

-

Or, if many employees need their deductions end dated, please submit a ticket in the Help Community using the taxonomy Benefits Administration > Employee Benefit Data.

-

-

Since the Post Tax Deduction deduction type is not currently able to be scheduled, when creating a new Post Tax Parking or Post Tax Transit deduction type:

-

Ensure that employees’ Pre Tax Parking/Transit and Post Tax Parking/Transit deductions have the same deduction schedule.

-

Failure to do so will result in your Pre Tax and Post Tax commuter deductions being applied at different frequencies, which can create confusion for administrators and employees.

-

Mid-Year Deduction Schedule Changes

If you have already completed your enrollments and the number of pay periods has changed due to a change in deduction frequency (e.g., your deduction frequency has changed from Exclude Third Pay Date (biweekly) or Fifth Pay Date (weekly) to First Scheduled Pay Date of the Month), you will also need to adjust your enrollments to ensure that your employees are deducted the proper amounts per pay period.

This is because updating your deduction frequency on the company level in the middle of a plan year without updating the amounts that an individual is contributing could result in the employee contributing the wrong amount.

For example, if you are an employee paid semimonthly, and you contribute $25 per pay period (or $50 per month) towards your parking deduction, if you just update your company parking deduction frequency to First Scheduled Pay Date of the Month, the employee now will only contribute $25 to their parking deduction on the first scheduled pay date of the month, and thus, under-contribute to their deduction.

In this case, post-enrollment deductions will need to be adjusted for your scheduled cycles manually.

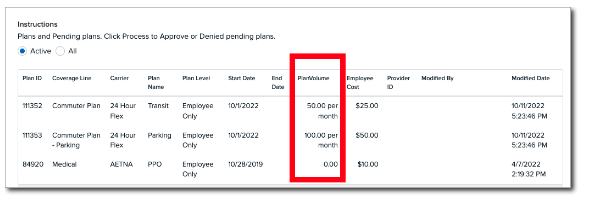

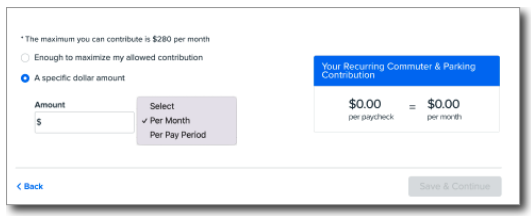

Viewing Employee Contributions & Plan Volumes

Employees and administrators who have used previous versions of the Enrollment Wizard may note that contribution options are now limited to amount Per Month (Parking/Transit), Per Year (HSA/FSA), and Per Pay Period (all) and that the option to view contributions by annual amount is no longer available.

Avoiding annual employee contribution elections eliminates the need for administrators to calculate pay period amounts or manually suppress deductions to avoid exceeding annual contribution elections.

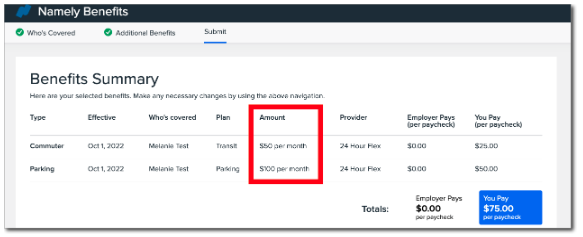

If employees want to view Plan Volumes, these amounts are available in the Enrollment Wizard on the Benefits Summary page.

Administrators can view plan volume amounts in the Plan Benefits tab of the employee’s profile in Namely Payroll.